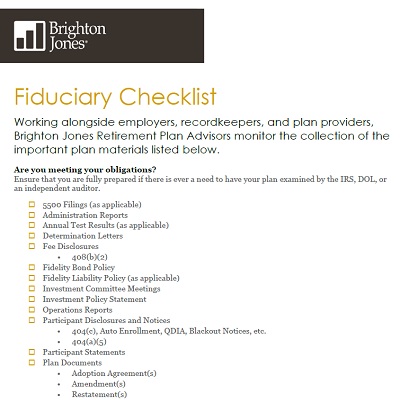

Are you meeting your obligations?

Proactive, informed management of retirement plans often results in lower plan costs, better investment returns, and ultimately employees not delaying retirement due to lack of adequate savings.

Given the complexity of sponsoring a retirement plan, falling short on fiduciary responsibilities is easy to do and doesn’t necessarily involve unethical behavior or gross negligence. Not reviewing your plan frequently enough or failing to document decisions can lead to a breach.

Having a comprehensive checklist that also acts as the central repository of the schedule, timing, and completion of compliance processes is essential to proper documentation.